Reviewing Your Financial Health

It has never been more important to set goals to secure your financial health than for the upcoming year. If we can take supplements and exercise to safeguard our physical health, and work with others to improve our mental health, how can we look out for our financial health?

The best way to do that is by actively reviewing your current financial status. If your goal is to achieve healthy finances, there are a few key ideas that we recommend as a starting point. This post will explore the ins and outs of financial health and share some important tips on how to improve yours!

What Is Financial Health?

Before we can begin to review your financial health, we must first understand what financial health means. Some describe it as individuals having sufficient cash flow for what they need and want, now and in the future.

This means knowing your current financial status, and whether or not it’s been meeting your wants and needs. So, take the time to examine your cash flow and ask yourself: does this satisfy my wants and needs?

Why Is Financial Health Important?

This leads onto our second key idea, understanding why financial health is important. Much like the importance of planning your retirement, it gives an individual the opportunity to structure their finances to cater to their current and future circumstances.

This is especially important in today’s environment where every day can present a host of unknown variables. It’s essential to educate yourself about your finances, and to revisit this annually to adjust it to match your changing attitudes and goals.

Contact us if you’d like some help with your financial planning. We have a proven track record in helping our clients turn around their financial health.

Our client *Imraan had unstructured finances before he began his journey towards financial health. Since he has begun working with us at Maysure Financial Services, he says he is reaping the benefits of “better investment decisions, improved yields, a positive lifestyle adjustment, and financial happiness”. The right financial advisor will help you achieve these benefits and shape your wealth so that it works for you.

How Can We Achieve Financial Health?

Now, you might be wondering where to start. Luckily, we have provided four steps to help you effect successful and productive financial changes.

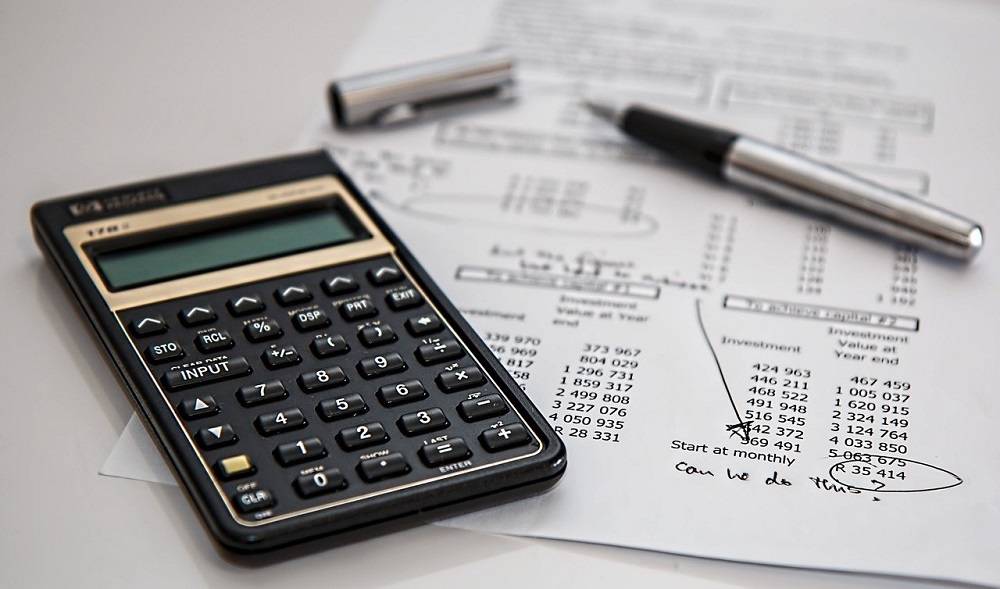

1. Determine your net worth

This is as simple as minusing your total liabilities from your total assets. To begin, you will need to calculate your total assets. This is anything you currently own, such as your house, your car, or other investments. Liabilities are any debt that you owe to a third party such as loans, shopping accounts, or credit card debt.

Here is a useful application to help you calculate your net worth. For those that like a working example, here’s one for you:

Let’s say you own a car worth R160 000 and a house worth R1 200 000, this would bring your total assets to R1 360 000. For calculating liabilities, let’s say you owe around R500 000 on your house, and you have an outstanding debt worth R25 000, this puts your total liabilities at R525 000.

A formula would look like this: total assets – total liabilities = net worth. Your net worth could be negative or positive. Either way, this means you have an idea of where your finances sit and can start to evaluate your financial health.

2. Calculate your debt to income ratio

Now, let’s look more closely at your monthly financial status, which is your debt-to-income ratio. In basic terms, this means how much you owe each month versus how much you earn each month.

For example, if you pay R10 000 on your house bond and R2 000 on your shopping account, and earn R24 000 then your ratio for each month would be 1:2. This makes it around 50 percent. You want your ratio to be much lower, i.e. you want your ratio to be at around 20 percent, which means your debt takes much less than half of your income.

3. Work with financial goals

Once you understand more about your financial status, you can start to set some goals about where you want it to be. This means being realistic about your monthly budgets, and ensuring that you’re not spending more than you earn. The goal here is to be able to have a steady cash flow so you can afford all your needs and wants, meaning you gain good financial health.

Effective budgeting ensures your financial resources are sufficiently distributed to cover your wants and needs. At this point, it is also very useful to seek out the assistance of your financial adviser. We can help you to work on an investment plan. Both of these in tandem will help to keep track of your spending while growing your wealth.

Saving is not as simple as just putting money away for a rainy day. It’s crucial you choose your investment accounts thoughtfully. Consider having multiple investment accounts that cater to various needs, for example, tax-free investment isn’t intended for emergency funds, but is useful for long-term investment.

4. Take a moment and enjoy your financial health

It’s easy to get bogged down with trying to save money and allocate your wealth responsibly. But, remember that it’s just as vital to enjoy your wealth by budgeting for those getaways and personal spoils. It’s possible to enjoy your finances once you have a realistic idea of your net worth, your income-to-debt ratio, and long-term goals.

This doesn’t mean allocating half of your monthly earnings to lifestyle expenses, after all, lifestyle inflation can become costly in the long run. But, rather allow yourself calculated luxuries that will still help you maintain your financial health status.

Final Thoughts on Financial Health

Financial health is an important aspect of living that you can learn to make work for you. By reviewing your financial health, you can get more realistic about where you are and as a result, start to plan for where you want to be. Now and in the future. We are here to help you tackle ‘the how’ of financial health and make your money work for you.

Please do not hesitate to get in touch to find out how to make your money work for you:

+27 11 839 2302

info@maysure.za.com