Sygnia Health Innovation Global Equity Fund – Ahead of the Curve

We have previously spoken about the idea of offshore investing as a method of diversification into foreign assets. This strategy is usually associated with gaining exposure to the power of the USD. However, it’s equally attractive to be able to participate in global trends and market sectors that are traditionally under-performing and/or under-developed in the local South African context.

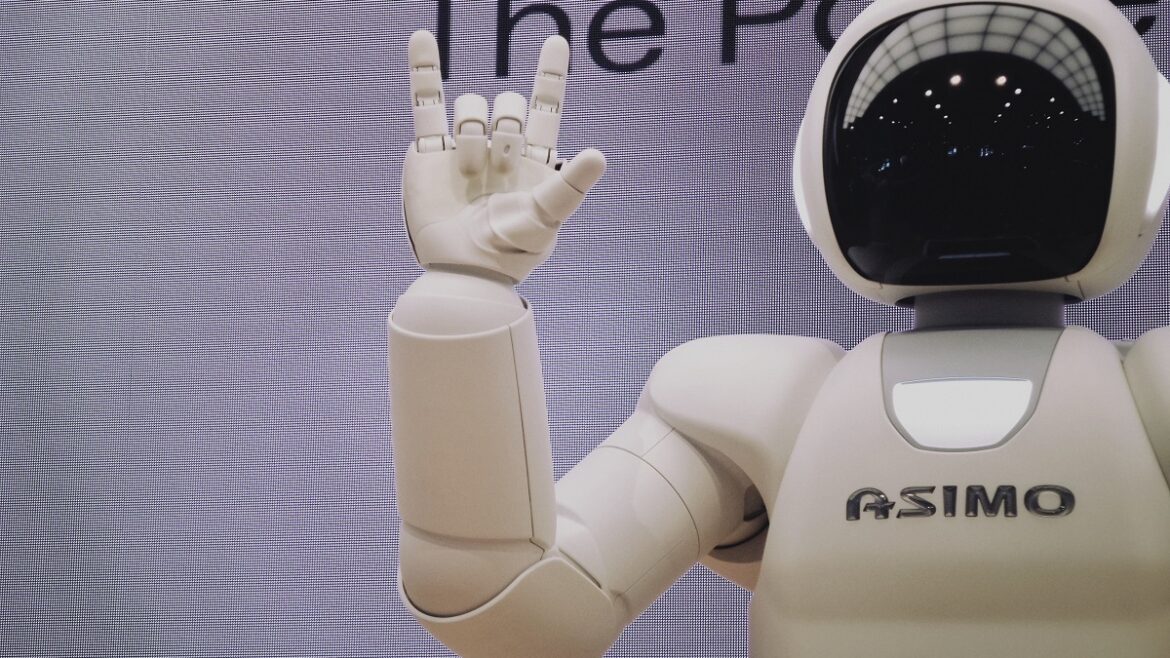

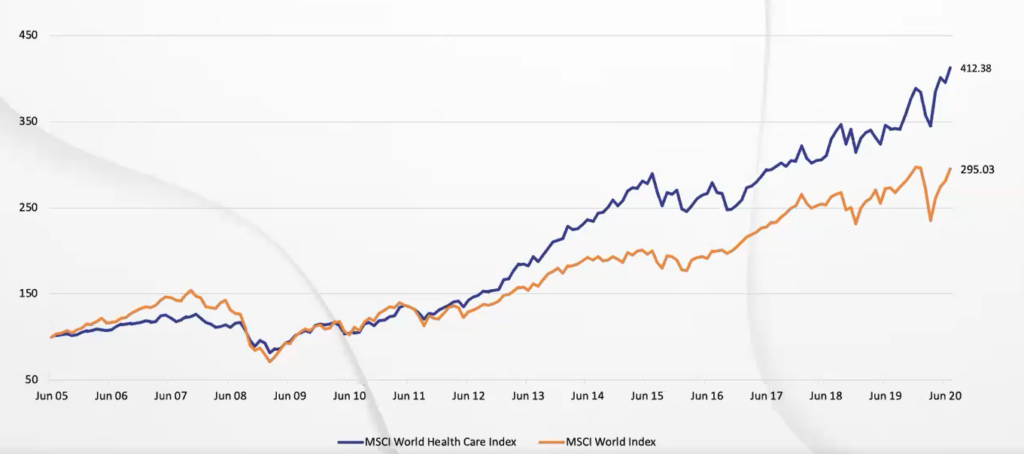

The health sector is a prime example, but with the launch of the new Sygnia Health Innovation Global Equity Fund on 5 August 2020, South Africans now have the opportunity to benefit from the watershed innovations happening in the field that will undoubtedly shape the landscape for years to come. And, as can be seen from the below graph, the health sector is a highly lucrative one.

Healthcare As a Trend

A sobering fact is that the market cap of the five largest pharma companies (~$1.3 trn) outstrips the size of the JSE (~$1.1 trn). A contributing factor to these impressive numbers is the cutting-edge nature of modern medical advances. As per a PwC report, these advances are being driven by huge investments with $169.5 billion being pumped into research and development in healthcare in 2018 alone. Somewhat surprisingly, this amount exceeds that spent on computing and electronics during the same period.

Another report released by Deloitte in 2019 put the expected annual growth of global healthcare spending at 5.4%, rising to $10.1 trillion by 2022. Notably, this is before taking into account the effects of the Covid-19 pandemic, which have yet to be fully felt.

Another influence on the increasing demand for healthcare services is that of an aging population. Demographic data shows a rise in the average age of many developed countries’ populations. In the USA, the median age has risen to 38 while in the European Union the over-65 age bracket accounts for 19.8% of the population in 2018 – expected to reach 31.3% by 2100.

As per the below graphic from McKinsey Global Institute, the benefits of a healthier population are many and far reaching. As such, the long-term incentives are set to remain for progress in the sector.

Innovations:

While the field is by its nature both complex and diverse, the Sygnia Health Innovation Global Equity Fund’s focus is on companies involved in the following innovations:

– Next-generation genetic sequencing and targeted healthcare (customised to suit the individual)

– 3D-printed devices (lower cost, highly customised)

– Virtual reality (simulated training environments)

– The use of AI in diagnostics

– Point-of-care diagnostics (fast diagnostics as you wait, the benefit of which has highlighted difficulties faced during Covid-19 testing)

– Virtual medicine (remote consultations)

– Biosensors and health monitoring trackers (remote diagnostics)

– Immunotherapies to extend cancer survival rates

Who Does the Fund Invest In?

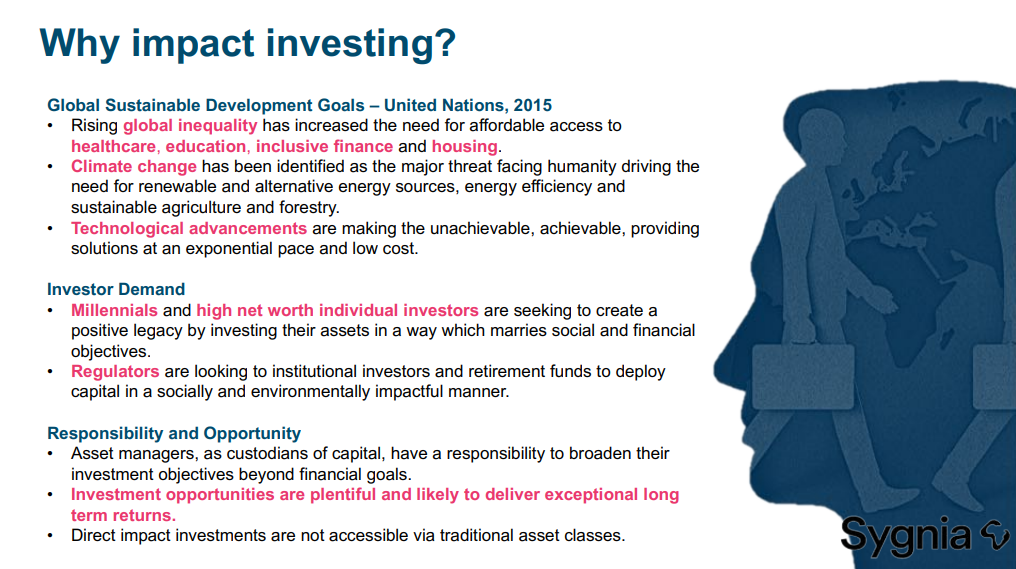

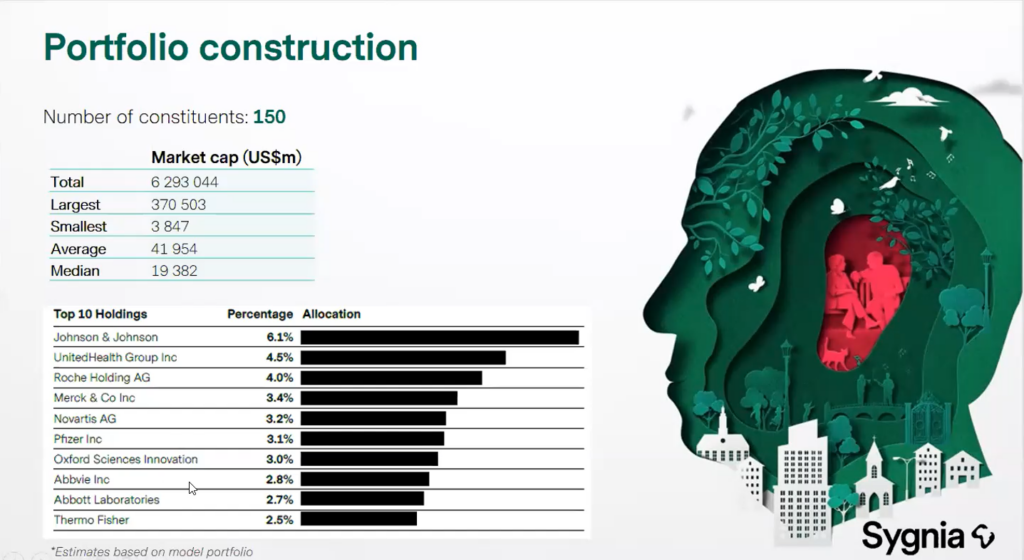

The Sygnia Health Innovation Global Equity Fund uses a dynamic indexation strategy to select the companies in the fund. As such, any potential investments must be securities traded on developed market exchanges. The Sygnia portfolio manager makes use of the Global Industry Classification Standard (GICS) to gain a weighted top 150 companies index based on free float-adjusted market capitalisation. Also pivotal to the process is using an ESG (Environmental, Social and Governance) screen as a primary criterion. This gives investors peace of mind knowing that they are in alignment with the global trend of good business practice through the principle of impact investing, as seen in the Sygnia OSI Fund.

What Does the Fund Aim to Achieve?

According to Sygnia, the investment objective of the fund is to “deploy capital so as to generate socially impactful and sustainable long-term return, where exceptional performance goes hand-in-hand with changing lives for the better by redefining healthcare – more value, better outcomes, greater convenience, access and simplicity; all at a lower cost.”

In terms of a quantifiable metric, the Sygnia Health Innovation Global Equity Fund aims to outperform the returns of the MSCI World Health Care Net Total Return Index, which is widely believed to be the benchmark for the sector. Boasting returns of 18% in rand terms since 1995, it is clear to see the benefits for investors if this target is met.

For more information on this fund feel free to get in touch:

+27 11 839 2302

info@maysure.za.com