Gap Cover Benefits: The Shocking Truth About Medical Aid Fees

South Africans are spending more each year on private health cover. Medical insurance has never been more prioritised than now. Yet, it might surprise you to learn that many people still do not have enough money to cover their medical expenses.

Even with the most comprehensive medical cover, you could still pay up to 400% above this tariff. This comes at a hefty cost to unsuspecting consumers. The shocking truth is that even with medical aid quite a few health expenses still need to be paid out of pocket.

As a result, medical gap cover has become a necessity. Carry on reading to find out the benefits of gap cover.

Why Do We Need Medical Gap Cover?

Gap Cover is a short-term insurance product that helps you with financial shortfalls, or “gaps”. These “gaps” can occur when doctors, specialists, and professionals charge more than your medical aid’s rates.

Gap cover helps to cushion the blow. It.carries a person’s medical costs, where that person can’t do it themselves.

While it doesn’t take the place of medical cover, it can cover a significant amount of the shortfall. Gap cover ensures you are not hindered with unexpected medical expenses when you are at your most vulnerable.

Gap Cover for Medical Aid: Benefits

Your medical aid may offer coverage of up to 100% of the medical scheme rate, but that doesn’t mean you’re fully protected.

Health care providers and practitioners do not need to comply with regulations when it comes to fees. They can charge over 100%, which can put you in a troublesome position.

Luckily, gap cover comes with several benefits. Let’s take a look at these benefits below.

Medical aid gap cover assists with cancer procedures

This type of cover has once-off benefits that can be used in the situation of:

- A first-time cancer diagnosis

- Accidental full disability

- Accidental permanent disability, or

- Accidental death.

Gap cover helps with certain casualty fees

Many people who have visited casualty have had the doubly unpleasant experience of having to pay the resulting expenses themselves. Luckily, some gap cover products include a benefit that helps you with any casualty-related expenses.

Offers coverage of certain co-payments

Some medical procedures attract co-payments or fees that are not covered by medical aid. These types of procedures include, among others, radiology scans and claims associated with oncology.

Thankfully, gap cover bridges the shortfall and can cover co-payments.

Secures peace of mind and is inexpensive

Protection against the unforeseen and unknown goes a long way in securing your family’s hopes for the future.

Obtaining gap cover means that in the instance you or a family member are hospitalised, you won’t have any sneaky costs making an already-scary situation worse.

In addition, the premiums for this type of insurance product are not expensive, especially when compared to the extensive benefits they offer you and your loved ones.

That said, you must do the research on the gap cover products available and how they work in alignment with your medical aid scheme.

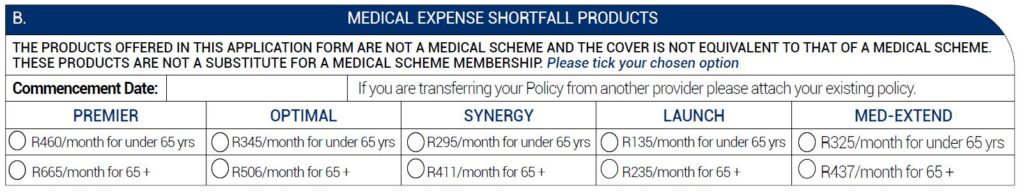

At Maysure Financial Services, we use Turnberry as our Gap Cover product. More on this below.

Turnberry Gap Cover

We at Maysure use Turnberry as a gap cover short-term insurance provider. We believe it to be one of the top gap cover providers South Africa has to offer.

Their products offer benefits including, but not limited to:

- Protection against unforeseen medical expense shortfalls

- Provision of comprehensive cancer benefits

- Enhancement of medical aid schemes by up to 500% of medical aid rates

- Affordable prices

- Coverage for Defined Procedures

- Extended family cover

- Emergency assistance by air, land, or sea

—

Please do not hesitate to get in touch for further information or to make arrangements:

+27 11 839 2302

info@maysure.za.com