Sygnia Itrix 4th Industrial Revolution

Sygnia continue to make global technologies available to local investors.

Before the launch of the Sygnia FAANG Equity

What exactly is the fourth industrial revolution?

In essence, an industrial revolution is defined as being a period of major industrialisation in manufacturing and a revolution in power. The first industrial revolution saw the mechanization of agriculture and textile manufacturing. The second industrial revolution was centred in the expansion and development of electricity, chemicals, petroleum, and all things that can be made and consumed using these. The third industrial revolution saw the rise of nuclear energy and electronics such as telecommunications and computers.

The fourth industrial revolution began the minute the internet became a reality and is rooted in the new technology phenomenon, digitalisation. Where globally, every single thing has the potential to connect to whatever else may potentially exist. This is giving the human race the opportunity to build a virtual world that works towards connecting everyone, everything and every process imaginable.

This is why the Sygnia Itrix 4th Industrial Revolution Global Equity ETF is so unique and exciting for investors. While it is a high-risk fund, it offers investors access to global companies whose core focus is new technologies and innovations that have the potential to transform the global economy in ways we have only imagined until now.

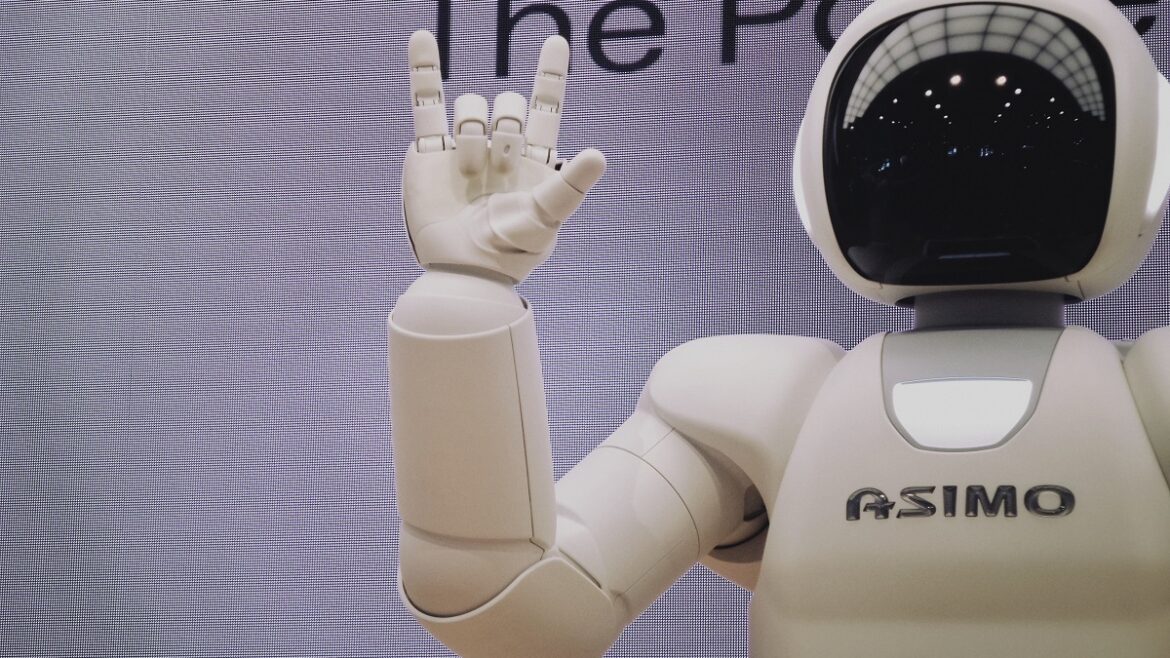

It captures the 21st Century Sectors that are propelling the 4th Industrial Revolution and fostering new industries that will transform every facet of our lives. The term “4th Industrial Revolution” has become widely accepted as the name associated with the concept of a revolution which will fundamentally change the way we live, work and relate to one another. It is characterised by the coming online of a range of new technologies that are fusing the physical, digital and biological worlds and impacting all disciplines, economies and industries.

But what exactly is KNEX?

It’s a US Analytics organisation, which is funded by companies such as Goldman Sachs, Google Ventures, CNBC, among others. KNEX essentially uses and understands big data and natural language programming, which they use to scan public information and financial statements online to identify the companies who are at the forefront of fourth industrial revolution. Each index focuses on different sectors, and includes companies producing and developing a wide range of technology that include robotics, space, cybersecurity, nanotechnology, genetic engineering, clean energy and so much more.

The objective of this portfolio is to provide simple access to investors who want to financially benefit from up and coming technologies. Sygnia suggests a minimum investment period of 5 years.

“In addition to tracking market indices, Sygnia manages the allocation between different sectors and indices in a dynamic manner based on its proprietary investment approach and methodology” – Sygnia

If you would like more information, get in touch with us.

Sygnia released the FAANG fund shortly after the 4th Industrial Revolution, you can read all about it here.