Bonitas Medical Aid: Affordable, Flexible Healthcare for South Africans

When it comes to securing reliable medical cover in South Africa, Bonitas Medical Aid stands out for its affordability and flexibility. With over 40 years of experience and a reputation for offering diverse options, Bonitas has become one of the most trusted medical schemes in the country. Whether you’re looking for comprehensive cover or something more budget-friendly, Bonitas has a range of plans to suit different needs and financial situations. Let’s break down their options and help you decide which Bonitas plan might be the best fit for you and your family.

Why Choose Bonitas Medical Aid?

Bonitas has a mission to make quality healthcare accessible to all South Africans. With a wide network of healthcare providers and hospitals, their plans are designed to give you access to private medical services while ensuring you’re not overwhelmed by costs. Bonitas also offers several unique benefits, such as preventative care services, wellness programmes, and maternity cover, making it a popular choice for individuals and families.

Whether you’re young and healthy or managing a family, Bonitas has plans that cater to every stage of life. Let’s take a closer look at the range of options.

Bonitas Medical Aid Plans

Bonitas offers a range of medical aid plans to fit different budgets and healthcare needs. These options allow you to choose the level of cover you require based on your health and financial situation:

- BonComprehensive Plan

This is Bonitas’ top-tier option, offering extensive cover for both in-hospital and day-to-day medical expenses. It includes unlimited hospital cover and a high level of benefits for consultations, medication, and specialist visits. The BonComprehensive Plan is ideal for families or individuals who need regular medical care and want peace of mind knowing that most of their medical costs will be covered. - BonClassic and BonComplete

These mid-tier plans provide solid in-hospital cover along with a savings component for day-to-day expenses. You’ll have access to private hospitals, and your savings account can be used for GP visits, medication, and other outpatient care. These plans strike a balance between affordability and benefits, making them ideal for those who need a mix of hospital cover and day-to-day medical care without the full cost of a comprehensive plan. - BonSave

BonSave is a more budget-friendly option that offers in-hospital cover alongside a medical savings account for day-to-day healthcare costs. Once the savings account is exhausted, you’ll need to pay for day-to-day expenses out of pocket, but any leftover savings roll over to the following year. This plan is suitable for individuals or families who want hospital cover but prefer to manage their own routine healthcare costs. - BonFit Select

Designed for healthy individuals or young families, BonFit Select offers hospital cover through a network of private hospitals and designated providers, making it one of the more affordable options. It includes limited day-to-day benefits but is an excellent choice if you rarely need to visit the doctor and want to save on monthly premiums. - Primary and BonEssential Select

These are entry-level plans that provide hospital cover only, at more affordable rates. You’ll still have access to private hospitals, but the day-to-day benefits are minimal. These plans are great for young professionals or healthy individuals who primarily want protection for major medical events, like surgery or emergency hospitalisation, without paying for benefits they don’t use regularly.

Key Benefits of Bonitas Medical Aid

Bonitas offers more than just medical cover. They provide a range of additional benefits that help you stay healthy while keeping your healthcare costs under control:

- Preventative Care

Bonitas includes various wellness benefits that cover preventative screenings, such as mammograms, pap smears, cholesterol tests, and flu vaccinations. These services help catch potential health issues early on, allowing you to take action before they become more serious—and more costly. - Maternity Benefits

If you’re planning to start or grow your family, Bonitas provides excellent maternity benefits. You’ll receive cover for antenatal check-ups, scans, and post-natal care, ensuring that both mother and baby are well taken care of during and after pregnancy. - Chronic Care Management

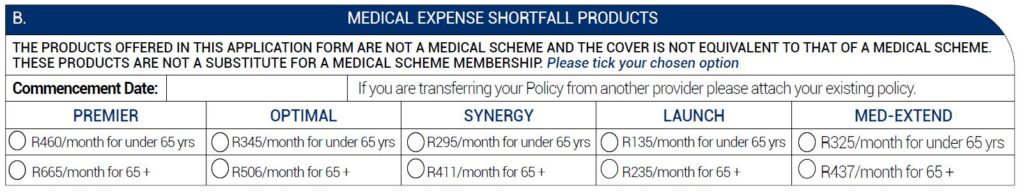

For members with chronic illnesses, Bonitas offers comprehensive chronic care management, covering medication, consultations, and specialist visits. This ensures that those living with long-term conditions receive the ongoing care they need to manage their health. - Gap Cover Options

While Bonitas provides excellent hospital cover, specialists or certain hospitals may charge more than your plan’s limit. This is where Gap Cover becomes essential. It helps bridge the shortfall between what your medical aid pays and what healthcare providers charge, ensuring you’re not left with large out-of-pocket expenses after hospital stays.

How to Choose the Right Bonitas Plan

With so many options, it’s important to choose a plan that suits your healthcare needs and budget. Here are a few things to consider:

- Family Size: If you’re covering a family, a more comprehensive plan like BonComprehensive or BonClassic may be worth the investment for the peace of mind it offers. Single individuals or young couples might prefer more affordable plans like BonFit Select or Primary.

- Health Status: If you need regular medical care or have a chronic condition, a plan with strong day-to-day benefits will help cover ongoing costs. If you’re generally healthy and only want hospital cover for emergencies, the lower-cost options like BonEssential Select could be the right choice.

- Budget: Medical aid is a long-term financial commitment, so it’s important to find a plan that fits comfortably within your budget. While more comprehensive plans offer greater cover, more affordable options may still give you the protection you need without overextending your finances.

Conclusion

Bonitas Medical Aid offers a range of plans to suit different healthcare needs and financial situations. Whether you’re looking for comprehensive cover or an affordable hospital plan, Bonitas has a solution for you. Their preventative care, maternity benefits, and chronic care management make Bonitas a strong contender for anyone looking to secure reliable medical cover in South Africa.

At Maysure Financial Services, we’re here to help you navigate your options and find the perfect medical aid plan for your needs. Get in touch with us today for personalised advice on choosing the best Bonitas Medical Aid plan for you and your family.